Award Recipients

2020

ROY MURA NAMED “FRAUD FIGHTER OF THE YEAR”

March 4, 2020, New York, NY — Roy A. Mura’s passion and professionalism within the anti-fraud world is widely known. In recognition of his dedication to fighting insurance fraud for the benefit of the citizens of New York State, he is now a member of an elite celebrated list of past awardees as NYAAIF’s 2020 “Fraud Fighter of the Year” recipient. Not only did Mr. Mura provide the keynote program, “Leaning to the Right – Applying Behavioral Economics to the Anti-Fraud Function” at this year’s Annual Meeting, he was surprised with the prestigious annual award at the conclusion of his presentation.

“Roy Mura has always excelled in his profession. His brilliant work, invaluable trainings for law enforcement and SIU personnel, and relentless dedication have earned him the utmost respect and appreciation from the legal and business communities. It is an honor for our organization to recognize his tireless efforts”, NYAAIF Chair Jim Potts commented after the award ceremony.

An instrumental pioneer in fraud prosecutions, Mr. Mura has been involved since the very beginning as this part of the industry originated and assisted in the formation the New York State Chapter of the International Association of Special Investigation Units.

Roy Mura is the founder and managing member of the seven-lawyer firm Mura & Storm, PLLC, headquartered in Buffalo, New York. He is a 1986 law graduate of University of Buffalo School of Law and a 1983 linguistics degree graduate of SUNY at Binghamton. The author of the widely read and award-winning Coverage Counsel blog (nycoveragecounsel.blogspot.com), Mr. Mura’s practice includes insurance coverage analysis and litigation, first-party property, third-party liability, auto/UM/UIM, no-fault, fraud and arson defense work for numerous property and casualty insurers on a state-wide and regional basis.

Having successfully litigated and tried numerous insurance fraud and coverage cases for insurers through trial and appeal in New York, he writes and speaks regularly and frequently for insurers, adjusters, and investigators nationwide on various issues relating to insurance coverage, including fraud, Internet of Things connected devices, social media research for claims, underwriting and fire investigations, “bad faith” and the defense of first- and third-party claims.

Mr. Mura is a member of and proudly serves as General Counsel to the New York State Chapter of the International Association of Special Investigation Units. He is also a member of the International Association of Arson Investigators, New York State Fire Investigators State Chapter No. 23, several local claims associations and the New York State and Erie County bar associations. He has been listed in the New York Super Lawyers – Upstate Edition since 2012 and maintains the highest possible AV (Preeminent) rating with Martindale-Hubbell.

Mr. Mura is married, has three children, four grandchildren, and all but gave up golf several years ago to maintain his “bass thumb” while pursuing his avocation for all-season fresh and salt-water fishing.

2019

POLICE OFFICER, GREG LEVINE, NAMED “FRAUD FIGHTER OF THE YEAR”

Police Officer Greg Levine is a 7.5 year veteran of the New York City Police Department who has been investigating automobile insurance fraud since 2015. Officer Levine has investigated hundreds of Grand Larceny Auto theft reports and as a direct result of his investigations he has made over 100 arrests for falsely reported auto thefts resulting in charges ranging from insurance fraud, grand larceny, arson and filing a false police report. Officer Levine’s success in investigating auto fraud was instrumental in the forming of the Queens South Auto Larceny Fraud Investigation unit which was established March of 2017. He has trained three other investigators on his work model of auto fraud investigation and is the go-to investigator for the team’s fraud investigations. Officer Levine possesses an extensive knowledge in automobile electronics, collision forensics and is a holds a certification as an Automobile Service Technician by the National Institute for Automotive Service Excellence. He also holds a certification in vehicle electronic infotainment and telematics forensics as well as iVe certification from the Berla Corporation.

Officer Levine is continually tasked with investigating the most complex insurance fraud and arson cases within the Auto Larceny Fraud Investigation Unit. Officer Levine uses his relentless follow-up coupled with his innate drive to gather and secure enough case evidence to ensure successful prosecutions and to complete thorough investigations. Officer Levine is a true ‘outside the box’ thinker, a skill which makes him a formidable fraud investigator able to adapt quickly to new developments in his cases. Officer Levine is always willing to provide assistance in any form to his peers, his self-drive and genuine desire to seek out and address automobile fraud in the eight (8) police precincts he is assigned with covering is made apparent on a daily basis. Officer Levine is organized and he uses the contacts that he has established over the years to his advantage as it pertains to his fraud cases. Officer Levine continues to be an innovator in the world of auto fraud. He uses all of the resources at his disposal to conduct his fraud investigations and stays abreast of the latest technologies in an effort to establish an investigative edge. Officer Levine remains the benchmark of what skill set is required to most effectively combat fraudulently reported stolen vehicles. He continually works to learn new strategies and techniques and never accepts the status quo and always tries to push the investigative envelope.

2017

HOWARD GOLDBLATT NAMED “FRAUD FIGHTER OF THE YEAR”

March 16, 2018, New York, NY — In recognition for his many years of dedicated service in working to curb insurance fraud for the benefit of the citizens of New York State.

Howard Goldblatt has been Director of Government Affairs for the Coalition Against Insurance Fraud since its inception in 1993. His career in government and public policy started in New York and includes 10 years of service on Capitol Hill serving on legislative staffs of several members of Congress. Prior to joining the Coalition, he worked as a government affairs specialist for New York-based law firm of Sullivan & Cromwell in its Washington, D.C. office and as government affairs director for the National Health Council.

Howard has been a frequent speaker on all aspects of the legislative process and on insurance fraud issues. In his capacity for the Coalition, Howard has testified before numerous legislative committees concerning insurance fraud issues. Howard also has published articles on insurance fraud issues in trade journals and general circulation newspapers. Howard has made presentations at international insurance fraud conferences in Budapest, Hungary (2001), Washington, DC (2002) and Amman, Jordan (2006). Howard also advises the National Association of Insurance Commissioners (NAIC) and the National Conference of Insurance Legislators (NCOIL) on insurance fraud issues.

Howard is a member of the Louisiana State Police Insurance Fraud & Auto Theft Advisory Board, the Virginia State Police Insurance Fraud Advisory Board and the New Mexico Insurance Fraud Taskforce. Howard also is a consumer member of the NAIC- Consumer Liaison Committee that advises the NAIC on insurance consumer issues.

Howard holds a B.A. in political science from SUNY, New Paltz where he is a member of the Advisory Board for the College of Liberal Arts and Sciences and an M.A. in politics and government from New York University.

The award highlighted the Alliance’s annual meeting this week. The Alliance comprises more than 100 insurers combating insurance crime by educating New Yorkers about fraud’s high costs to consumers throughout the state.

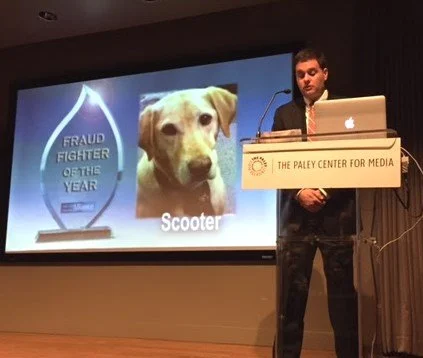

Scooter was a rescue dog. She joined the Rockland County fire unit in 2006. She and Lerner were inseparable in teaming to investigate fires. Arson dogs such as Scooter can smell 100,000 times better than humans. She could discover tiny amounts of gasoline or other firestarter amid piles of blackened ruins. Her evidence proved crucial in helping earn arson and insurance-fraud convictions, said Alliance chair Jim Berrigan, in presenting the award.

Scooter’s evidence led to dozens of convictions. Many involved homes or other buildings burned for insurance schemes. The conviction rate is four times higher for law enforcement departments with canine crime fire fighters.

Discovered in a Chicago dog shelter, Scooter graduated from a rigorous national training program to become a certified arson dog. Only about one of 10 canines graduate. Most are Labrador retrievers. Their keen noses and inquisitive, outgoing personalities make them natural fits for scouring rubble for clues.

Scooter’s friendly personality also made her a favorite in the sheriff’s department, and she delivered results. Scooter helped teach school kids about fire safety as well. Scooter’s demonstrations were popular among students and teachers.

The training of Scooter and her handler was funded by a grant from State Farm.

Source: InsuranceFraud.org

2016

ARSON DOG, SCOOTER, NAMED “FRAUD FIGHTER OF THE YEAR”

March 08, 2017, New York, NY — A remarkable arson dog whose nifty nose earned dozens of arson convictions was named New York’s top fraud fighter for 2016.

The trained yellow Labrador retriever Scooter had a memorable 10-year career before passing away in October 2016. She investigated several hundred fires with the Rockland County Sheriff’s Department. She also worked cases for adjacent counties.

Her longtime handler Det. Doug Lerner accepted the Fraud Fighter of the Year award posthumously from the New York Alliance Against Insurance Fraud today.

“The IG’s efforts put teeth behind our anti-fraud marketing campaigns in providing valuable deterrence though public awareness and vigorous prosecution,” Berrigan said in presenting the award. He also commended Scott for reaching out and working with insurers to identify fraud trends and develop strategies to counter them.

NYAAIF also previewed its 2016 consumer campaign. It will include TV & radio ads, billboards and a roaming “Fraud Squad” van plastered with anti-fraud messages. The campaign theme is “Insurance Fraud Hurts . . . Everyone.” It launches in May.

Frank Orlando, head of the fraud unit of the state Department of Financial Services, briefed fraud fighters on no-fault fraud trends in the state. The Massachusetts Insurance Fraud Bureau profiled a huge automobile rate- evasion ring that operated in New York and Massachusetts.

NYAAIF also elected four members to three-year board terms: Jim Potts (New York Central Mutual), Frank Sztuk (Hanover Insurance), Ken Jones (Travelers) and James Egner (Farmers Insurance).

NYAAIF is an alliance of 104 insurance companies in New York. NYAAIF was created in 1999 to educate consumers about the cost of insurance fraud and help consumers avoid becoming victims. Visit www.fraudny.org.

2015

INSPECTOR GENERAL IN NEW YORK NAMED “FRAUD FIGHTER OF THE YEAR”

March 3, 2016, New York, NY — Cited for an aggressive campaign to counter workers-compensation scams throughout the state, New York Inspector General Catherine Leahy Scott was honored with the “Fraud Fighter of the Year” award by the New York Alliance Against Insurance Fraud.

The award was presented during NYAAIF’s recent annual meeting held here.

NYAAIF Chair Jim Berrigan credited the IG’s leadership in compiling an impressive record of prosecuting wide-ranging workers-compensation cases. They included fraud by claimants, medical providers and businesses.

Successful prosecutions of no-fault clinics, doctors, dentists, contractors, personal-injury attorneys and people who lie to receive Medicaid benefits were among Vance's achievements, Berrigan said.

Vance also publicly supported legislation last year creating a law to criminalize the practice of coordinating staged auto crashes to bilk New York's no-fault system.

Police and firefighters allegedly fabricated psychiatric conditions, many supposedly stemming from 9/11. They sought to fraudulently obtain hundreds of millions of dollars in federal disability payments, Vance said in a keynote address to the NYAAIF members.

"These defendants are accused of gaming the system by lying about their lifestyle, including their ability to work, drive, handle money, shop and socialize, in order to obtain benefits to which they were not entitled," Vance said.

Vance also briefed NYAAIF members on a workers compensation premium-fraud report released yesterday by a grand jury he empaneled.

Fraud by employers in the construction industry alone totaled nearly $500 million each year in New York, Vance said. New steps are needed to prevent and detect workers comp fraud. Increasing penalties for large-scale scams, requiring insurers to conduct more audits of business they insure, and issuing ID cards to workers to use when seeking medical treatment were among the report's recommendations.

2014

MANHATTAN DISTRICT ATTORNEY CYRUS VANCE HONORED WITH 2014 "PROSECUTOR OF THE YEAR" AWARD

Praised for his willingness to prosecute all types of insurance fraud, Manhattan District Attorney Cyrus Vance was honored as 2014 Prosecutor. Vance took on a complex and massive disability fraud case against more than 100 New York police and fire fighters.

"In addition to this complex and wide-ranging disability case, the Manhattan DA's office has compiled an impressive list of other successful insurance-fraud cases," NYAAIF Chair Jim Berrigan said in presenting the award during the group's annual meeting.

In 2004, an Alnutt-owned rental property in Johnstown was destroyed by fire, but the investigation fell short of the threshold for prosecution and remained inactive. In 2007, another fire occurred at an Alnutt-owned property in Gloversville, which destroyed the building and resulted in the death of tenant Debra Morris.

After interviewing more than 30 witnesses and working long nights and weekends, Sira discovered that Alnutt was in deep financial trouble, and was set to make $200,000 from the destruction of the building.

Sira’s dedication to rooting out the truth, ability to piece together a complex case, and leadership in the prosecution eventually led to Alnutt’s 25-year sentence.

“Sira succeeded despite difficult circumstances, budget constraints and few support staff,” said John Sargent, NYAAIF chair during the awards presentation. The award was presented by New York Frauds Bureau investigator Phil D’Angelo, who worked with Sira on the case. “Through hard work and relentless drive, District Attorney Sira took down a dangerous case of greed.”

The NYAAIF award launched this year, seeking to recognize best practices and outstanding success in prosecuting insurance fraud in New York. NYAAIF is an alliance of more than 100 insurance companies in New York that was created in 1999 to educate consumers about the cost of fraud and to help consumers avoid becoming victims. For more information, visit www.fraudny.org.

2011

NEW YORK D.A. NAMED PROSECUTOR OF THE YEAR

ALBANY - Bringing down a deadly insurance arsonist has earned Fulton County District Attorney Louise K. Sira, the first-ever Prosecutor of the Year award by the New York Alliance Against Insurance Fraud (NYAAIF).

Sira spearheaded a two-year, multi-agency investigation that resulted in the conviction of Jeffrey Alnutt, his daughter and son-in-law for a deadly insurance-based arson. Alnutt was sentenced to 25 years to life in state prison.